The one thing investors can’t ignore in 2023

2023 is going to have a lot of moving parts. What does inflation do? What will be the posture of…

Accelerating Sustainable Finance: Joint Industry Statement

Demonstrating our collective willingness to work together to enable the finance sector to make a larger contribution to the climate,…

How Metrics is navigating a rising interest rate environment

Andrew Lockhart, Managing Partner from Metrics Credit Partners shares insights on private debt with James Marlay from Livewire Markets. In…

Metrics Reflect Reconciliation Action Plan

We are proud to present Metrics first Reconciliation Action Plan which outlines our plans for building respect for the knowledge, cultures and traditional practices of Aboriginal and Torres Strait Islander peoples.

Calm amid the turbulence: interest rates, volatility and private debt

The steepest rise in official interest rates since the 1990s is fuelling the hunt for investments that can preserve capital…

Five-year anniversary of the launch of Metrics Master Income Trust (ASX:MXT)

Metrics Master Income Trust (ASX:MXT) pioneered public market access to the fast-growing world of private debt in Australia when it…

Zenith ‘Meet the Manager’ Interview with Andrew Lockhart

Metrics Direct Income Fund (MDIF) has received a “highly recommended” rating – the highest possible – from Zenith Investment Partners….

Finding defensive investment income without increasing risk

The RBA’s latest interest rate rise – which takes the cash rate to 2.35%, the highest level since 2014 –…

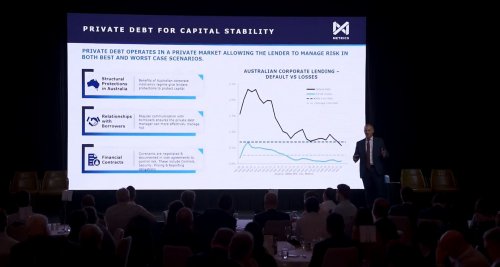

Andrew Lockhart on protecting your portfolio with private debt

At the Pinnacle Investment Summit 2022, Metrics Managing Partner, Andrew Lockhart presented a compelling case on private debt and explained…