How Metrics is navigating a rising interest rate environment

Andrew Lockhart, Managing Partner from Metrics Credit Partners shares insights on private debt with James Marlay from Livewire Markets.

In June 2013, a group of former-NAB executives built upon their lengthy careers in banking to open the doors to a new boutique investment firm. Following the GFC, the Managing Partners identified a trend that would see Australia’s major banks scale back their direct lending to certain sectors of the corporate loan market, creating an opportunity for a new breed of private lenders to step in.

That firm is Metrics Credit Partners, which started with a single investor with $75 million to get the firm rolling. Under Managing Partners Andrew Lockhart, Justin Hynes, Graham McNamara, and Andrew Tremain, Metrics has established itself to become the largest non-bank lender in Australia.

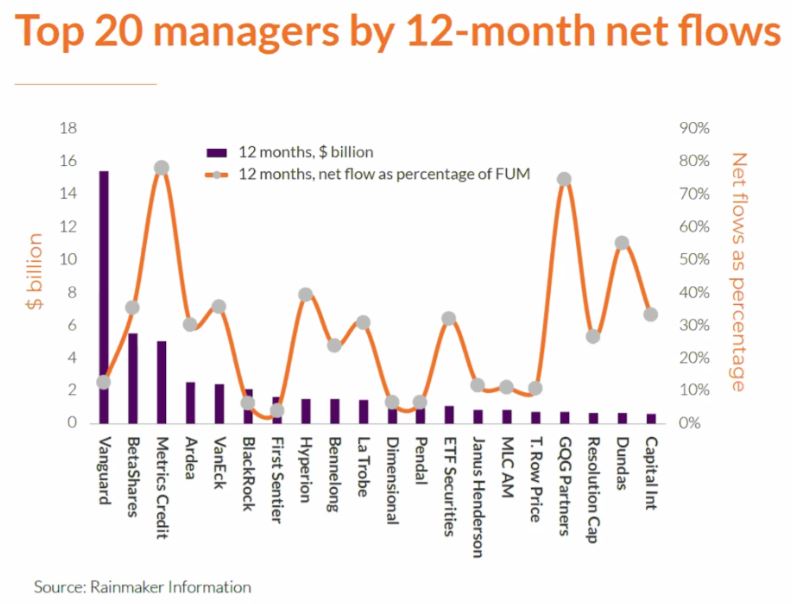

Ten years on, Metrics now has more than $13 billion in funds under management. So how did they do it? For one, Private Debt has become more recognised as an asset class, and exchange traded products as an access vehicle have continued to be popular. These two trends were identified by analysis from Rainmaker Information based on fund flow data for FY22.

The Rainmaker analysis shows that Metrics ranked third overall based on net fund flows and was the top-ranked active manager behind ETF providers Vanguard and Beta Shares.

We recently spoke with Andrew Lockhart to get an update on the growth of Metrics, how the current business cycle impacts the firm’s lending activities, and how investors are protected in a rising interest rate environment.

You can watch the interview by clicking on the player or by reading an edited transcript below.

Topics discussed

- 0:00 – Introduction to Metrics Credit Partners

- 1:00 – Opportunity in Private Debt

- 3:08 – Benefits of scale for credit investors

- 4:26 – Where are we in the market cycle for real estate?

- 8:03 – Inflation or Interest Rates – what has had the biggest impact?

- 10:15 – Is the property sector still appealing for lenders?

- 11:36 – How Metrics navigates a rising rate environment

- 13:43 – An explanation of how floating rate exposures work

- 14:51 – Outlook for defaults in the loan market

- 18:14 – Opportunities in the current market

Other News

Podcast: The Rules of Investing | From Cold Call to Capital Giant

In this episode of The Rules of Investing, Metrics Group CEO & Managing Partner, Andrew Lockhart discusses the conditions that…

Metrics Credit Partners Completes Acquisition of Taurus and BC Invest

Metrics Credit Partners (“Metrics”), a leading Australian based alternative asset management firm, has today successfully completed the acquisition of Taurus…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange