Who we are

We are a leading Australian non-bank corporate lender and alternative asset manager with ~$23bn in AUM, specialising in fixed income, private credit, equity and capital markets.

Through our managed funds we provide unrivalled access to the highly attractive Australian private debt market to investors ranging from individuals to global institutions.

We offer tailored borrowing solutions to corporate and other entities of all sizes and across all industries in Australia, New Zealand and developed Asia.

We launched our first wholesale fund in 2013 and we are the manager of a number of wholesale investment trusts in addition to the Metrics Master Income Trust (ASX:MXT), which listed on the ASX in October 2017, Metrics Income Opportunities Trust (ASX:MOT) which listed on the ASX in April 2019 and the Metrics Real Estate Multi-Strategy Fund (ASX:MRE) which successfully listed on the ASX in October 2024.

We have established a range of innovative investment products that are designed to provide investors with access to investment opportunities that seek to provide capital stability and regular income.

Metrics’ experienced investment team comprises the four founding partners and is supported by a team of highly qualified investment professionals with skills and experience covering origination, credit and financial analysis, portfolio risk management, legal and fund administration.

OUR EDGE

As an independent, alternative asset manager, we are able to think quickly and act fast.

Combine this with our wealth of knowledge and we have the flexibility and capability to deliver opportunities right across the risk spectrum driving superior returns for our investors. Our expertise spans all levels of the capital structure, from investment grade to sub investment grade assets.

We have a long track record of partnering with corporate borrowers across industries, the credit spectrum and loan products, to deliver bespoke borrowing solutions.

Our borrowers and investors take comfort from our investment team having an average of 30 years’ each of experience in funds management, corporate finance, banking, and portfolio risk management.

OUR PHILOSOPHY

We never stop seeking out new opportunities for our clients to generate wealth. Whether it’s providing borrowers with bespoke lending transactions to help achieve their goals, or creating new ways for investors to access diverse alternative assets, we have your measure.

For investors, we drive active strategies that yield a target return, while maintaining a strong focus on investor capital preservation. Summed up in one distinct formula:

ORIGINATION

portfolio

construction

& PORTFOLIO RISK

MANAGEMENT

OF SCALE

OUTPERFORMANCE

At Metrics we believe private markets investments provide superior risk-adjusted returns compared with other investment options.

We drive portfolio diversity by investing across the credit spectrum, capital structure, borrowers, industries, and debt products.

Our scale enables us to participate alongside syndicate banks or meet borrowers’ needs on our own.

As an agile and independent non-bank lender, our philosophy is to work collaboratively with companies and deliver debt solutions to help them realise their business goals.

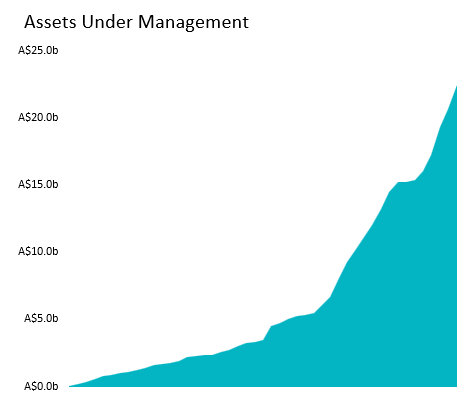

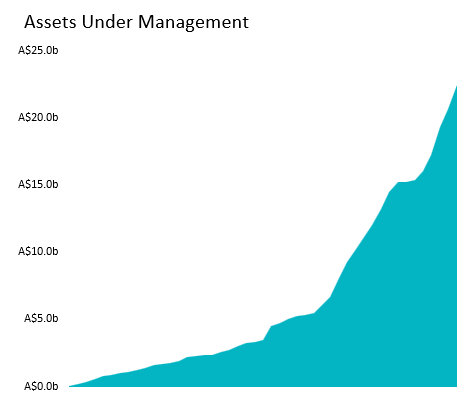

PROFIT FROM GROWTH

Our assets under management continue to grow. That’s thanks to our continued focus on building strong partnerships with corporate borrowers and managing risks to deliver returns for investors. We have an impressive track record in identifying market opportunities that produce attractive risk-adjusted returns while meeting our stringent risk assessment requirements.

We believe investment portfolio diversification is important. By investing in private markets, our funds seek to deliver returns that are uncorrelated to listed equities or public market debt securities.

Andrew Lockhart

Managing Partner + Investment Committee

Andrew has more than 30 years’ banking, funds management and financial markets experience specialising in leverage and acquisition finance as well as corporate and institutional lending. Andrew’s considerable experience includes being responsible for the origination and portfolio risk management of large, diversified and complex loan portfolios including corporate restructurings. Andrew holds a Bachelor of Business and Masters of Business Administration from the Queensland University of Technology.

Justin Hynes

Managing Partner + Investment Committee

Justin Hynes has more than 20 years’ experience working across loan origination, structuring and portfolio management. Justin has extensive acquisition and corporate finance experience in both an advisory and principal capacity in Australia and South East Asia, including workouts and restructurings. Justin holds a Bachelor of Commerce and Bachelor of Japanese Studies from the Australian National University

Graham McNamara

Managing Partner + Investment Committee

Graham has 40 years’ experience in banking, funds management and financial markets and has established the loan syndications and agency businesses at major Australian banks. He has considerable experience in risk management, debt origination and distribution, agency management and corporate banking. Graham has been a director of the Asia Pacific Loan Market Association and was the founding chairman of the Association’s Australian Branch. He is a Member of the Australian Institute of Company Directors.

Andrew Tremain

Managing Partner + Investment Committee

Andrew has more than 30 years’ experience in corporate loans, structured, leverage and acquisition finance, funds management, portfolio management and relationship management across Australia, Europe and Asia. Andrew holds a Bachelor of Commerce from Macquarie University

Who we are

We are a leading Australian non-bank corporate lender and alternative asset manager with ~$23bn in AUM, specialising in fixed income, private credit, equity and capital markets.

Through our managed funds we provide unrivalled access to the highly attractive Australian private debt market to investors ranging from individuals to global institutions.

We offer tailored borrowing solutions to corporate and other entities of all sizes and across all industries in Australia, New Zealand and developed Asia.

We launched our first wholesale fund in 2013 and we are the manager of a number of wholesale investment trusts in addition to the Metrics Master Income Trust (ASX:MXT), which listed on the ASX in October 2017, Metrics Income Opportunities Trust (ASX:MOT) which listed on the ASX in April 2019 and the Metrics Real Estate Multi-Strategy Fund (ASX:MRE) which successfully listed on the ASX in October 2024.

We have established a range of innovative investment products that are designed to provide investors with access to investment opportunities that seek to provide capital stability and regular income.

Metrics’ experienced investment team comprises the four founding partners and is supported by a team of highly qualified investment professionals with skills and experience covering origination, credit and financial analysis, portfolio risk management, legal and fund administration.

OUR EDGE

As an independent, alternative asset manager, we are able to think quickly and act fast.

Combine this with our wealth of knowledge, and we have the flexibility and capability to deliver opportunities right across the risk spectrum driving superior returns for our investors. Our expertise spans all levels of the capital structure from investment grade to sub investment grade assets.

We have a long track record of partnering with corporate borrowers across industries, the credit spectrum and loan products, to deliver bespoke borrowing solutions.

Our borrowers and investors take comfort from our investment team having an average of 30 years’ each of experience in funds management, corporate finance, banking, and portfolio risk management.

OUR PHILOSOPHY

We never stop seeking out new opportunities for our clients to generate wealth. Whether it’s providing borrowers with bespoke lending transactions to help achieve their goals, or creating new ways for investors to access diverse alternative assets, we have your measure.

For investors, we drive active strategies that yield a target return, while maintaining a strong focus on investor capital preservation. Summed up in one distinct formula:

ORIGINATION

portfolio

construction

& PORTFOLIO RISK

MANAGEMENT

OF SCALE

OUTPERFORMANCE

At Metrics we believe private markets investments provide superior risk-adjusted returns compared with other investment options.

We drive portfolio diversity by investing across the credit spectrum, capital structure, borrowers, industries, and debt products.

Our scale enables us to participate alongside syndicate banks or meet borrowers’ needs on our own.

As an agile and independent non-bank lender, our philosophy is to work collaboratively with companies and deliver debt solutions to help them realise their business goals.

PROFIT FROM GROWTH

Our assets under management continue to grow. That’s thanks to our continued focus on building strong partnerships with corporate borrowers and managing risks to deliver returns for investors. We have an impressive track record in identifying market opportunities that produce attractive risk-adjusted returns while meeting our stringent risk assessment requirements.

We believe investment portfolio diversification is important. By investing in private markets, our funds seek to deliver returns that are uncorrelated to listed equities or public market debt securities.

Andrew Lockhart

Managing Partner + Investment Committee

Andrew has more than 30 years’ banking, funds management and financial markets experience specialising in leverage and acquisition finance as well as corporate and institutional lending. Andrew’s considerable experience includes being responsible for the origination and portfolio risk management of large, diversified and complex loan portfolios including corporate restructurings. Andrew holds a Bachelor of Business and Masters of Business Administration from the Queensland University of Technology.

Justin Hynes

Managing Partner + Investment Committee

Justin Hynes has more than 20 years’ experience working across loan origination, structuring and portfolio management. Justin has extensive acquisition and corporate finance experience in both an advisory and principal capacity in Australia and South East Asia, including workouts and restructurings. Justin holds a Bachelor of Commerce and Bachelor of Japanese Studies from the Australian National University

Graham McNamara

Managing Partner + Investment Committee

Graham has 40 years’ experience in banking, funds management and financial markets and has established the loan syndications and agency businesses at major Australian banks. He has considerable experience in risk management, debt origination and distribution, agency management and corporate banking. Graham has been a director of the Asia Pacific Loan Market Association and was the founding chairman of the Association’s Australian Branch. He is a Member of the Australian Institute of Company Directors.

Andrew Tremain

Managing Partner + Investment Committee

Andrew has more than 30 years’ experience in corporate loans, structured, leverage and acquisition finance, funds management, portfolio management and relationship management across Australia, Europe and Asia. Andrew holds a Bachelor of Commerce from Macquarie University