OVERVIEW

Unique Access to Investment Opportunities and Portfolio Diversification

The Metrics Master Income Trust provides investors with the advantage of direct exposure to the Australian corporate loan market — a space dominated by the regulated banks.

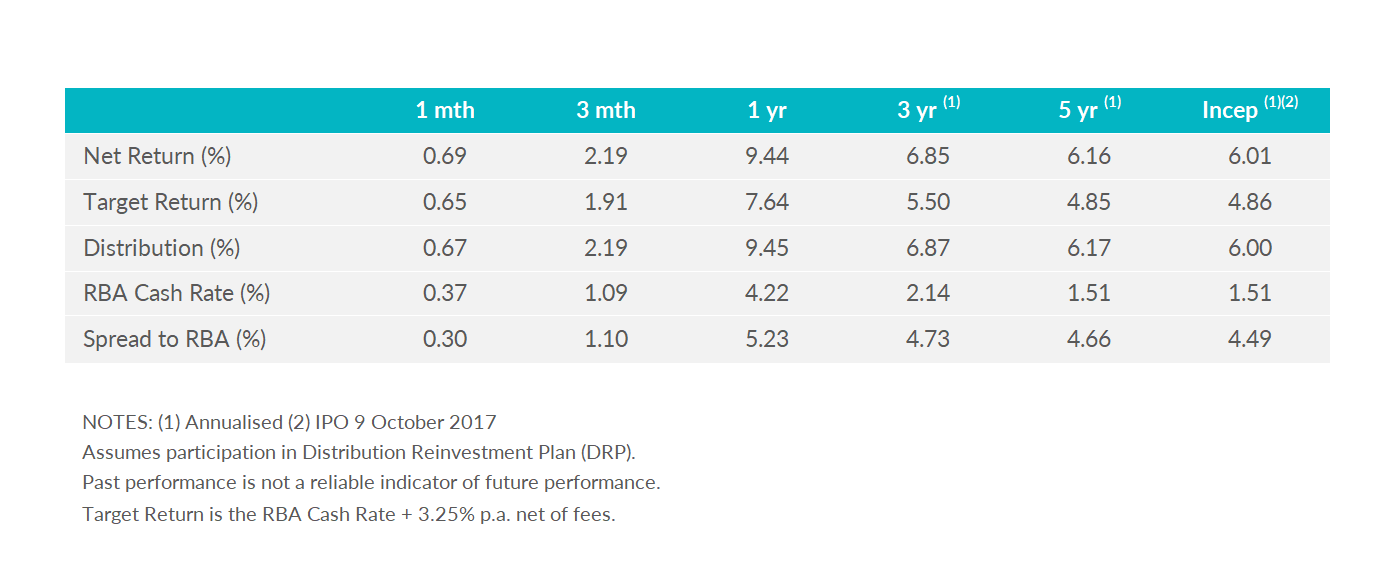

Attractive Monthly Returns

MXT targets a return of the RBA cash rate plus 3.25% p.a.* (currently 7.60% p.a. net of fees) through the economic cycle, with income distributions intended to be paid monthly.

Distributions

Distributions will be paid monthly. The Responsible Entity has established a Distribution Reinvestment Plan (DRP) which allows Unitholders to reinvest monthly income distributions.

WHY INVEST IN MXT

As a respected, Australian based alternative asset manager currently managing in excess of A$17 billion in assets, we’re experts at originating, structuring, negotiating, executing, distributing and managing portfolio risk associated with private market assets. MXT seeks to provide investors with:

- Monthly cash income with reduced capital volatility

- Attractive risk-adjusted returns from a diversified portfolio

- Portfolio diversification from an investment in Australian corporate fixed income

- An experienced, active management team

Who is MXT for?

At Metrics, we believe that fixed income is an important feature of a balanced portfolio and is an increasingly attractive asset class for investors seeking capital stability, regular income and building a more defensive strategy.

An investment strategy that seeks to preserve capital and offers opportunity

MXT’s investment strategy is to provide exposure to Australian corporate loans that generally reflect bank market activity, diversified by borrower, industry and credit quality. Through active portfolio risk management, we seek to balance investor requirements for return and capital .

EXTERNAL RESEARCH

MXT Unitholder Information

Stay up to date with key ASX announcements including latest earnings, annual reports, important performance updates and other information.

Find out more about our latest news and information.

Private debt is made for today’s market

Metrics Credit Partners Diversified Australian Senior Loan Fund upgraded to ‘A-’ by S&P

MXT Entitlement and Shortfall Offer – Livewire video

MCP Master Income Trust (ASX:MXT) Entitlement and Shortfall Offer Opens

MCP Master Income Trust change to offer timetable

OVERVIEW

Unique Access to Investment Opportunities and Portfolio Diversification

The Metrics Master Income Trust provides investors with the advantage of direct exposure to the Australian corporate loan market — a space dominated by the regulated banks.

Attractive Monthly Returns

MXT targets a return of the RBA cash rate plus 3.25% p.a.* (currently 7.60% p.a. net of fees) through the economic cycle, with income distributions intended to be paid monthly.

*This is a target return and may not be achieved.

Distributions

Distributions will be paid monthly. The Responsible Entity has established a Distribution Reinvestment Plan (DRP) which allows Unitholders to reinvest monthly income distributions.

WHY INVEST IN MXT

As a respected, Australian based alternative asset manager currently managing in excess of A$17 billion in assets, we’re experts at originating, structuring, negotiating, executing, distributing and managing portfolio risk associated with private market assets. MXT seeks to provide investors with:

- Monthly cash income with reduced capital volatility

- Attractive risk-adjusted returns from a diversified portfolio

- Portfolio diversification from an investment in Australian corporate fixed income

- An experienced, active management team

- Low management fees

Who is MXT for?

At Metrics, we believe that fixed income is an important feature of a balanced portfolio and is an increasingly attractive asset class for investors seeking capital stability, regular income and building a more defensive strategy. MXT may be suitable for investors looking for regular monthly income without exposure to the volatility of the equity markets, and a reduced risk of capital loss compared to direct equity investments.

An investment strategy that seeks to preserve capital and offers opportunity

MXT’s investment strategy is to provide exposure to Australian corporate loans that generally reflect bank market activity, diversified by borrower, industry and credit quality. Through active portfolio risk management, we seek to balance investor requirements for return and capital preservation.

EXTERNAL RESEARCH

MXT Unitholder Information

Stay up to date with key ASX announcements including latest earnings, annual reports, important performance updates and other information.

Find out more about our latest news and information.

Private debt is made for today’s market

Metrics Credit Partners Diversified Australian Senior Loan Fund upgraded to ‘A-’ by S&P

MXT Entitlement and Shortfall Offer – Livewire video

MCP Master Income Trust (ASX:MXT) Entitlement and Shortfall Offer Opens

MCP Master Income Trust change to offer timetable

Disclaimer and disclosure

All website content in respect of the Metrics Master Income Trust ARSN 620 465 090 (the Trust) is issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235 150 (Perpetual) as responsible entity of the Trust. Metrics Credit Partners Pty Ltd ABN 27 150 646 996 AFSL 416 146 (Metrics) is the investment manager.

The information provided in this website is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Trust, you should consider the current Product Disclosure Statement (PDS) and Target Market Determination (TMD), and the Trust’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au/, and assess whether the Trust is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser.

Neither Perpetual nor Metrics guarantees repayment of capital or any particular rate of return from the Trust. Neither Perpetual nor Metrics gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this website. All opinions and estimates included in this website constitute judgments of Metrics as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.

The rating issued 08/2023 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2023 Lonsec. All rights reserved.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned 6 June 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at http://www.zenithpartners.com.au/RegulatoryGuidelines

The Independent Investment Research (IIR) rating requires to be read with the full research report that can be found on the issuers website (or upon request) together with their full disclaimer that is found on the front cover of their research note. IIR requires readers of their research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice just financial information without having regard too the financial circumstances of the reader.

Enquiries and Complaints

Perpetual’s complaints handling process has changed.

The Responsible Entity has established procedures for dealing with complaints. If an investor has a complaint, they can contact the Responsible Entity and/or the Manager during business hours, using contact details provided in the PDS. For more information on Perpetual’s complaints handling process, please click here.