NAV-igating through volatile times yields superior returns

It pays to look through market volatility and focus on net asset value in private credit, says Metrics Managing Partner, Andrew Lockhart.

Looking through the volatility of the past 18 months or so, it’s been a rewarding time for those fixed income investors who are prepared to look beyond the traditional staples of the asset class to products like private debt. This is especially true for investors in quality Australian ASX listed corporate loan funds, where the performance of the underlying assets has been stable, despite the volatility in traded prices.

Since the first COVID-19 lockdowns in March last year, investors who have been looking for yield have seen performance and stability in the corporate loans that are the underlying assets of our funds – the Metrics Master Income Trust (ASX:MXT) and Metrics Income Opportunities Trust (ASX:MOT).

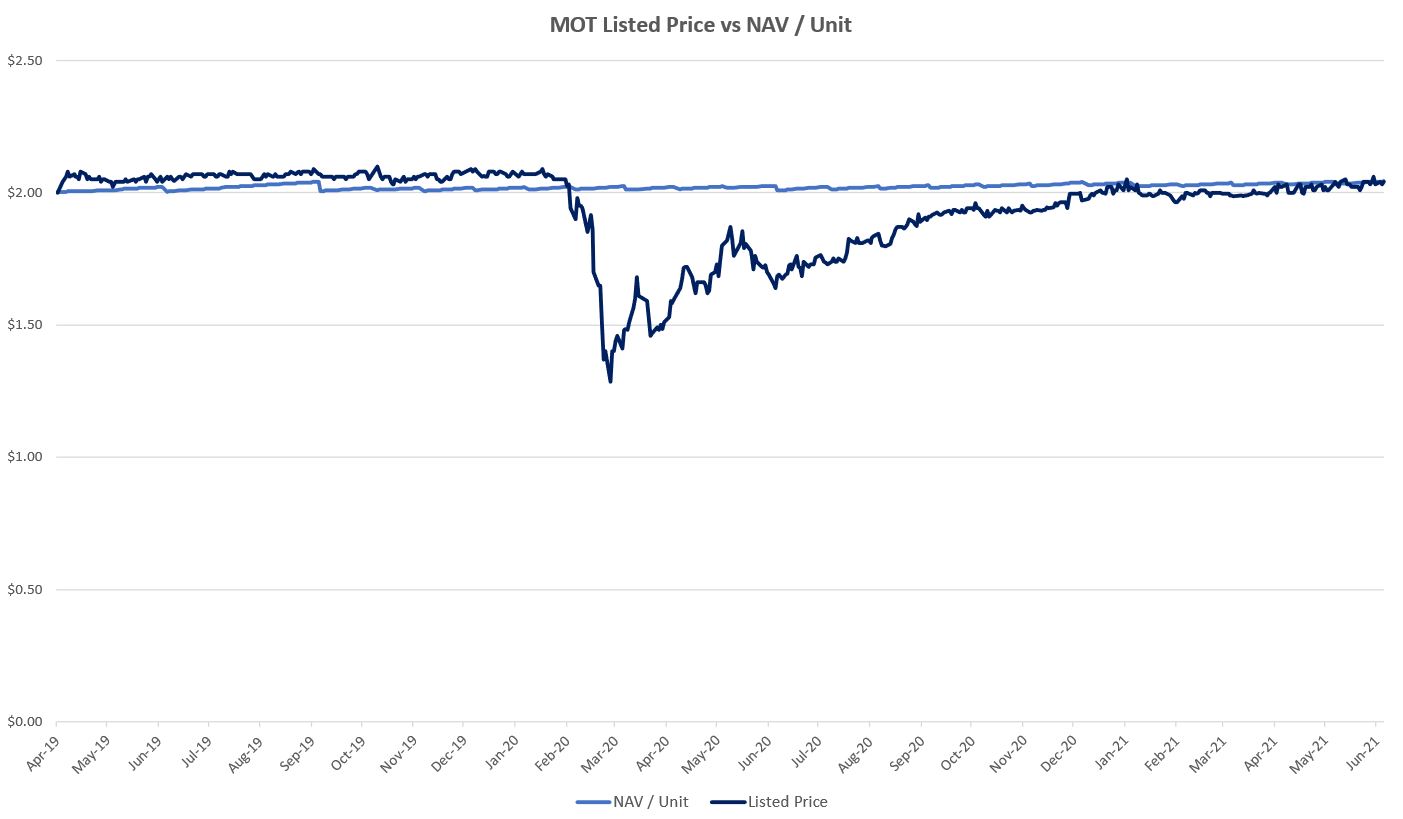

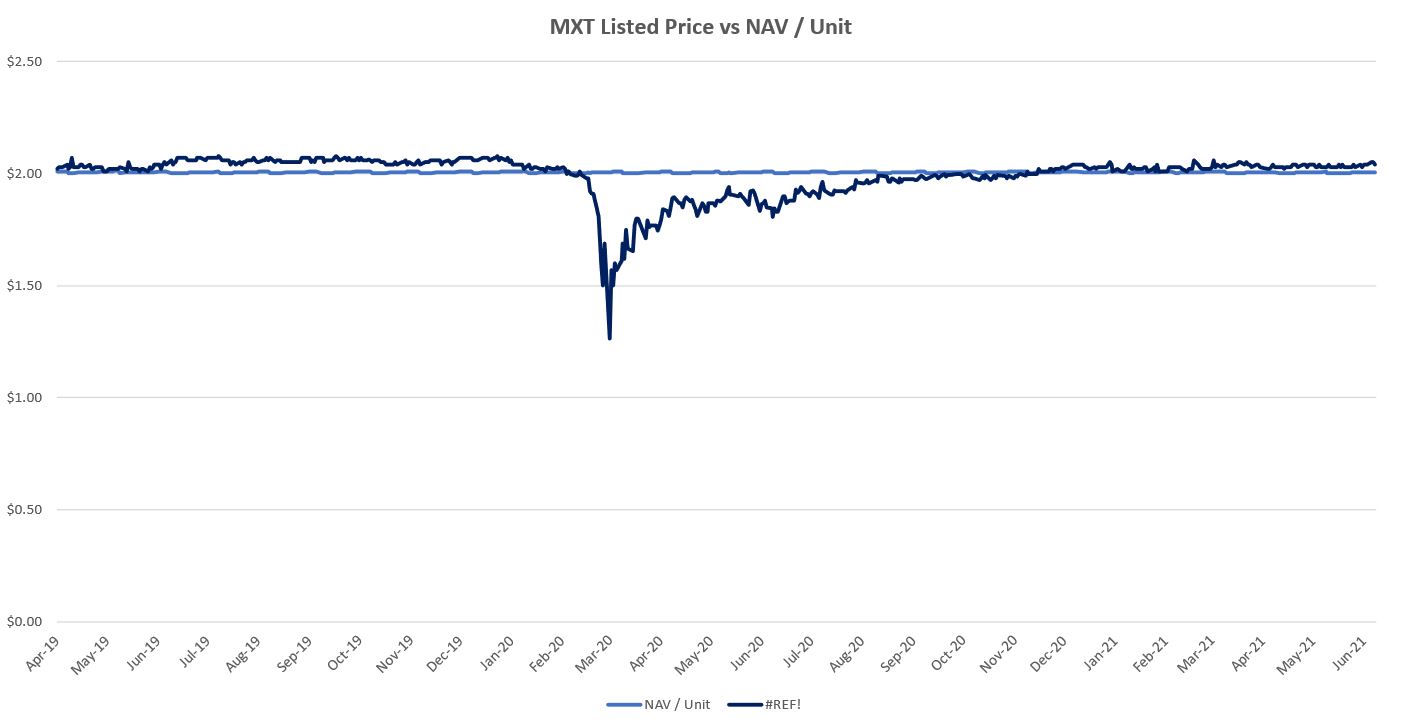

As investors became nervous about the trajectory of the economy in the first wave of COVID-19, investment markets sold off, creating a dislocation between the net asset values (NAVs) and the traded prices of MXT and MOT on the ASX.

In selling MXT and MOT and going to cash, investors inexplicitly expressed that there was potentially a risk of bad and doubtful debts or losses that they might be exposed to, or they just needed liquidity. Often when an investor needs liquidity everything gets sold and so the market price trades down.

However, the performance of the underlying assets in the funds has been very resilient. The quoted net asset values of MXT and MOT have never fallen below the IPO issue price of either fund, regardless of what was happening with the market price.

Corporate debt is a lower risk investment than equity because Australian insolvency laws give priority to the interests of creditors in claims over the assets of a business. Loans also enjoy covenants and controls that enable the lender to monitor risk and to step in to protect value when necessary. In private credit, lenders directly negotiate with borrowers, and thus have greater influence on terms. All of this means corporate loan loss rates for Australian companies have been very low for many years.

Corporate debt is a lower risk investment than equity because Australian insolvency laws give priority to the interests of creditors in claims over the assets of a business. Loans also enjoy covenants and controls that enable the lender to monitor risk and to step in to protect value when necessary. In private credit, lenders directly negotiate with borrowers, and thus have greater influence on terms. All of this means corporate loan loss rates for Australian companies have been very low for many years.

We also quote a daily NAV figure that gives investors an understanding of the value of the portfolio of loans that are held within our funds. Each day the assessed market value of portfolio assets and impairment testing is reviewed by the Metrics Investment Committee. Any adjustments to carrying values are reflected in the daily NAV with equity and equity-like positions held in MOT subject to periodic valuation assessments based on material information.

The valuation process is independently overseen by Perpetual, who is the Responsible Entity of both MXT and MOT. An international accounting firm undertake an independent credit risk and market pricing assessment and report this to the Responsible Entity each month. KPMG, as the auditor of both MXT and MOT, also undertake a similar process each half-year. Thus, there is a real rigour around the testing and risks associated with our loans and whether investors are exposed to any risk of loss and the reporting of this via the daily release of the NAV.

Unfortunately, in times of volatility you’ll get differences of opinion between investors as to whether to buy or sell and that liquidity affects the traded price. During March last year we experienced a material dislocation in the ASX traded price of both MXT and MOT to the point where there was a material discount to their quoted NAV.

Pleasingly, we have been able to report that there were no borrowers in our portfolio that were in arrears of principle or interest, and we didn’t incur any losses. As investors have seen the stability in NAV, improved market confidence, and the payment of monthly distributions, they have gained confidence in Metrics ability to manage the portfolio and deliver on the investment strategy.

That discount between the NAV and ASX traded price has flipped to a point now where both MXT and MOT are trading at a premium to the NAV. So, investors who have been looking for yield have been rewarded and, as a result of that, we’re pleased to have maintained the strong support of MXT and MOT investors.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange