How real estate debt can bolster income investments

A stable yield correlated with inflation is the chief attraction of this form of investment.

Most people might think a commercial property investment simply involves holding a stake in bricks and mortar. However, the fast-growing real estate debt market offers a different means to generate returns.

Real estate debt funds seek to generate income by providing loans to borrowers who need capital for commercial real estate activities. The returns to investors come from the interest and fees received from borrowers at specified intervals under binding terms of their loan contracts, minus fund costs.

Typical borrowers include companies and sponsors involved in the development, ownership or management of industrial, residential, office or retail properties. Loans can be used to fund various stages of a real estate project, including land purchase, pre-construction activities, construction, residual stock, or investment.

Real estate debt investments aim to produce higher yields than cash with less volatility than equity and fixed income bond investments.

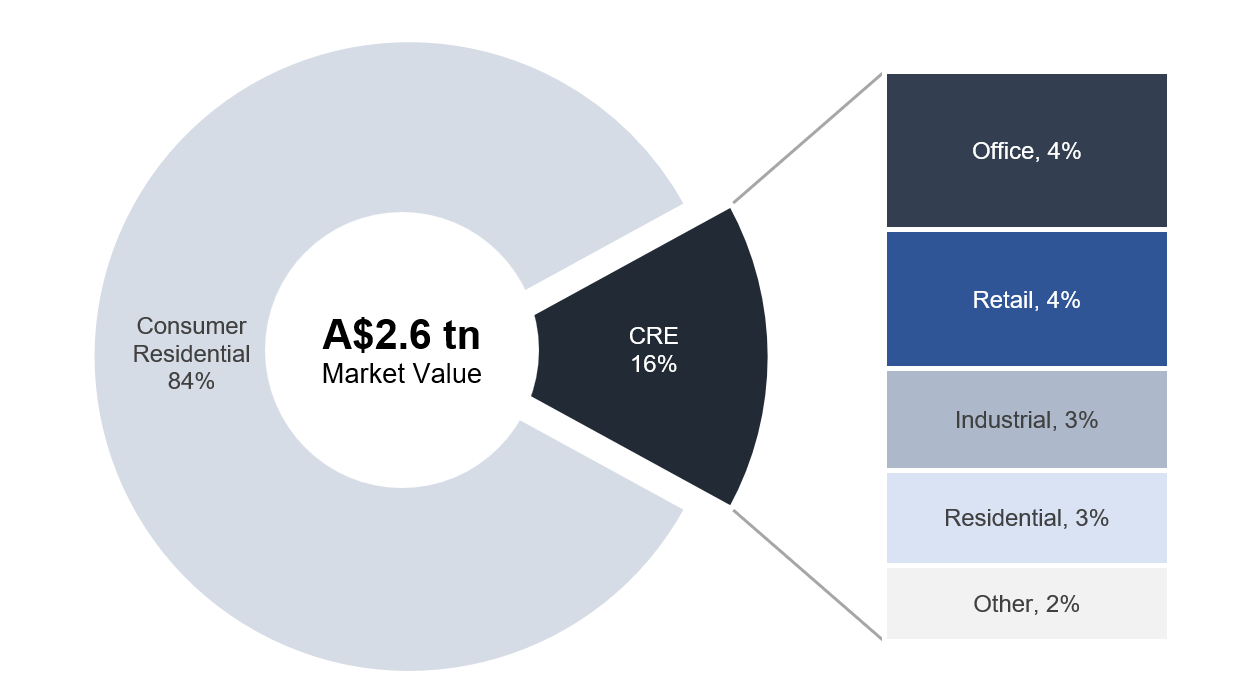

Although the Australian market in real estate debt is sizeable, avenues for retail investors to build an exposure to it has been limited. This is because major banks have historically dominated lending to the sector, with other lenders accounting for a much smaller proportion of activity.

However, recent regulatory pressure aimed at tempering banks’ relative growth to property has facilitated the opportunity for real estate investment funds, including those open to retail clients.

Source: APRA Quarterly ADI exposures (March 2024)

Commercial real estate lending has become one of the fastest-growing segments of Australia’s burgeoning private debt industry. However, like all investments, it requires careful consideration and selection. Not all funds are equal and it’s prudent to conduct due diligence to ensure that a fund manager possesses the expertise required to achieve optimal returns.

A competent manager will undertake detailed analysis prior to lending that includes:

- A project valuation by a licensed professional

- A risk and project feasibility report from an independent quantity surveyor

- Legal due diligence

- A security agreement over the borrower, a mortgage over the property and typically personal guarantees

- An agreed project budget and timeline

- Project cost and time contingencies

- Where relevant, an assessment of pre-sales confirming market acceptance of a project

Construction funding is provided in stages, with ongoing monitoring to ensure each real estate project in a portfolio is running as planned.

Below are four common questions that investors ask about real estate debt and its potential place in a diversified portfolio.

The emergence of real estate debt funds creates an opportunity for investors to diversify their portfolios with an asset that aims to generate higher yields in excess of the Reserve Bank of Australia (RBA) cash rate.

The majority of loans in a real estate debt fund tend to be floating rate, with an additional credit margin, which provides investors with a hedge against inflation. Returns also have a low correlation to other assets such as fixed income and equities.

The asset class may also provide an attractive alternative to listed Australian real estate investment trusts.

Loan covenants, contractual obligations and security provided by borrowers mean that an investment in real estate debt can offer reduced capital volatility. Loan loss rates tend to be low in well-run funds.

Real estate debt, like other forms of private debt, is not intended to generate capital gains.

Real estate debt funds typically seek to generate returns of 8-12% from a diversified portfolio of assets.

The returns are often floating rate, meaning total income generally moves in line with the RBA cash rate.

Floating rates help ensure returns keep pace with inflation, thereby helping investors to maintain their purchasing power. This is significant as it protects the value of savings and investments against the rising prices of goods and services rise.

Investing in a real estate private debt fund carries certain risks, primarily centred around borrowers’ ability to repay loans and the potential for secured assets to depreciate below the loan amount extended. However, these investments generally pose lower risks compared to equity investments, partly due to the prioritisation of creditors’ claims and Australian corporate insolvency laws, safeguarding their interests.

Skilled fund managers also mitigate risks by constructing diversified portfolios across:

- projects and borrowers

- sectors (industrial, retail, residential development and commercial)

- geography

- stage of development (both new and brownfield developments)

- position in the capital structure.

In addition to diversification, competent real estate debt fund managers employ strategies to minimise credit losses. They conduct rigorous assessments of borrower businesses before extending loans and negotiate customised covenants that enforce operational constraints. These covenants prioritise secured loans in the event of default, enabling recovery ahead of other unsecured creditors and equity holders. Furthermore, they enable the continuous monitoring and assessment of credit risk to adapt strategies as needed.

A real estate debt fund is the primary way to access the potential benefits of the asset class. It’s important, though, to properly assess the credentials of a fund manager before committing to an investment.

The key considerations when choosing include:

- Size and scale: Managers need a sizeable team, breadth of market coverage and borrower relationships to achieve proper diversification in private debt portfolios. The ability to lend larger sums also provides greater negotiating power in relation to loan terms and conditions.

- Origination capability: Check the manager has direct relationships with borrowers and other market participants to directly negotiate loan terms.

- Risk management capability: A strong focus on risk management and experience managing underperforming loans is essential to preserve investor capital.

- Track record of performance: Seek evidence that a manager has delivered capital stability and regular income payments to investors. It should also be able to demonstrate that it has met its stated investment targets over time.

- Diversification: Managers should maintain diversified portfolios to help spread risk across sectors. Investors should look for funds that are diversified across borrowers and ensure the exposure to any individual borrower does not result in inappropriate concentration of credit risk.

- Appropriate terms: When negotiating a transaction with a borrower, a fund manager must ensure that appropriate terms and conditions apply to the loan. It must also have in place controls that constrain the borrower and therefore protect investor capital.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange