History points to buying opportunity in private debt

In an environment of rising inflation and uncertainty about the economic outlook, well-managed private debt funds allow investors to allocate capital defensively without sacrificing returns.

That’s especially true for investors in quality Australian ASX listed corporate loan funds, where the performance of the underlying assets has been stable over the past 12 months, despite the volatility in traded prices.

In a period of stock market volatility, investors who have been looking for yield have seen performance and stability in the corporate loans that are the underlying assets of our listed funds1.

Yet, as investors become increasingly nervous about the trajectory of the economy and the impact of rising interest rates and inflation on asset values, investment markets are increasingly volatile, which often creates a dislocation between the net asset value (NAV) and traded prices of the Metrics Master Income Trust (MXT) and Metrics Income Opportunities Fund (MOT) on the ASX.

This reflects a possible misunderstanding of the qualities of private debt.

The asset class aims to offer a defensive income stream and protection against inflation for two reasons. Firstly, as most loans are secured, and secondly, returns typically rise in line with increases to the official interest rate, given that rates are linked to the bank bill swap rate. History shows that this misconception is a buying opportunity for savvy investors.

Lessons from history

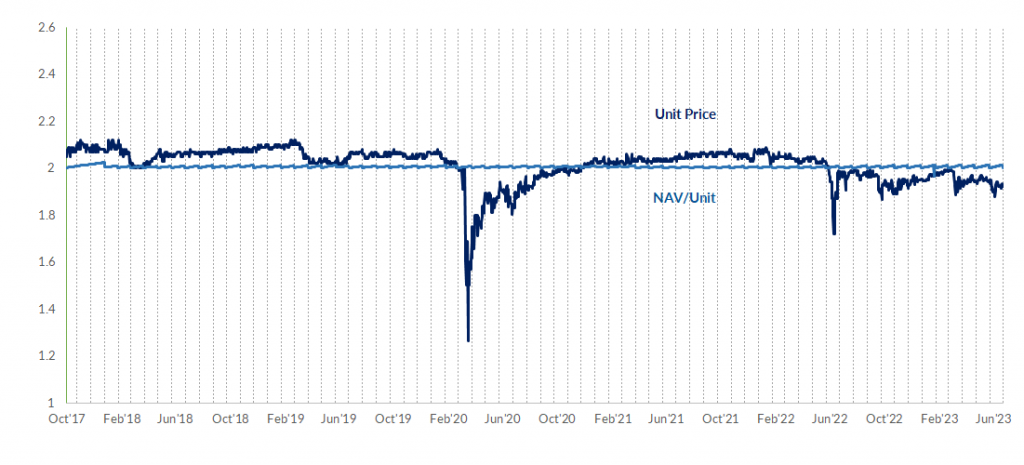

The last time MXT traded at a significant discount to the NAV was in March 2020, when investors became nervous about the trajectory of the economy in the first wave of COVID-19.

In that instance, selling MXT and MOT and going to cash, investors took the view that there was potentially a risk of bad and doubtful debts or losses that they might be exposed to, or they just needed liquidity. Often when an investor needs liquidity, everything gets sold and so the market price trades down.

However, the performance of the underlying assets in the fund was very resilient, and although nothing can be guaranteed, it is reasonable to expect that this resilience will be persistent over time. We were able to report that there were no borrowers in our portfolio that were in arrears of principal or interest, and that we didn’t incur any losses. We continued to prudently lend and manage portfolio risks.

As investors saw the stability in NAV and the payment of monthly distributions, they gained confidence in Metrics’ ability to manage the portfolio and deliver on the investment strategy. That discount between the NAV and ASX traded price flipped to a point where MXT was trading at a premium to the NAV. So, investors who had been looking for yield were rewarded.

Figure 1: MXT NAV/Unit and Listed Price Performance

No direct exposure to property prices

Despite the large inflows into private debt investments recently, many people don’t fully understand the asset class and the nature of its returns.

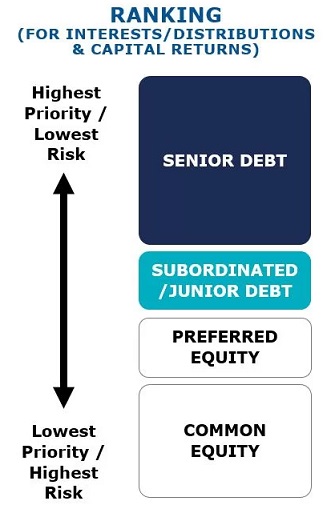

Concerns about the outlook for property prices have resulted in real estate investment trusts (REIT’s) and superannuation funds exposed to commercial office assets marking down carrying values. However, an attractive characteristic of private debt is the absence of direct exposure to a potential downturn in property equity values. That is, equity incurs the first risk of loss.

Unlike REITs, the objective of MXT is not to enjoy price gains on an equity exposure to property. Rather, the objective is to provide stability of capital and attractive income to investors.

Private debt can provide regular income even when property values are falling because interest and fee payments are received from borrowers at specified intervals under the binding terms of their debt contract. Security held over property assets aim to protect lenders from risk of loss.

By contrast, investors in REITS are typically exposed to volatility in property prices because these structures invest largely in property equity and returns may be adversely impacted by rising interest rates.

Reduced capital volatility even in a slowing economy

A key attribute of the asset class is that it usually provides reduced capital volatility through the economic cycle. MXT targets a net of fees return of the Reserve Bank of Australia (RBA) cash rate plus 3.25% (currently 7.35% p.a.)2 through the economic cycle, with income distributions intended to be paid monthly. Even throughout the sharp COVID-related economic downturn in 2020, we continued to deliver on this investment objective.

In the five years since listing, the NAV of MXT has remained at or above its $2 issue price and net returns have averaged 5.50% per annum3. This represents a spread of 4.39% to the RBA cash rate over the same period, well ahead of our target.

Debt is a lower risk investment than equity because equity wears the risk of first loss and Australian corporate insolvency laws give priority to the interests of secured creditors, like Metrics, in claims over the assets of a business.

This prioritisation makes private debt an especially attractive investment when the economy slows.

Figure 2: Senior debt position in the capital structure

In private debt, lenders directly negotiate with borrowers, and thus have greater influence on terms and pricing, so that the lender has adequate protection for the possibility of a loan default.

Loans also enjoy covenants and controls that enable the lender to monitor risk, and to step in, to protect capital, when necessary.

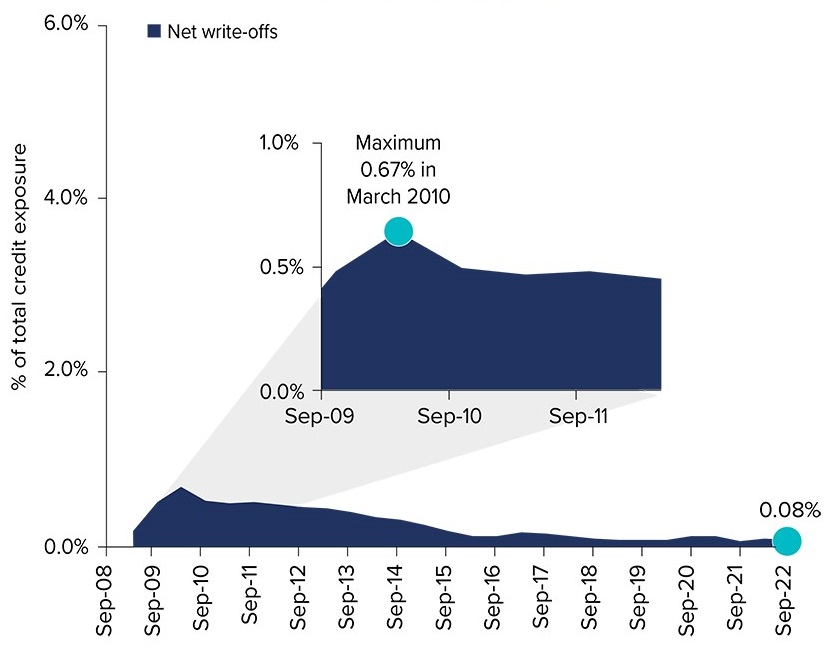

Taken together, all these considerations mean that corporate loan loss rates for Australian companies have been very low for many years.

Figure 3: Major Banks Historical Net Write-Offs

Returns rise with official interest rates

It is true that a rising inflation environment and the potential for interest rates to rise as a result can pose challenges for investors in traditional asset classes such as equities and bonds.

Unprepared investors in bonds risk missing out on the income boost from higher interest rates as the global economy recovers. The capital value of the fixed rate bonds in an investment portfolio will also depreciate because potential buyers are able to find more attractive returns elsewhere, not because the credit quality of the investment has deteriorated.

Corporate loans, however, offer protection against inflation because they earn their returns from interest that is generally charged with a floating rate of interest. The interest on Australian corporate loans is usually structured as an additional margin over the benchmark bank bill swap rate (BBSW).

BBSW is essentially the rate at which Australia’s major banks are willing to lend short term money to other banks. It reflects not only the current level of the RBA cash rate, but also the expectations the banks have of future cash rate settings.

In essence, the linking of corporate loan interest to BBSW means that if official interest rates are on the rise, so too will be the returns you are receiving on the floating rate loans you are invested in.

In this way, the returns on corporate loans tend to keep pace with inflation, helping investors to maintain their purchasing power, even as prices of goods and services rise.

Investors should focus on the NAV ahead of the ASX-listed price

When investing in private debt, it is important to look through fluctuations in the ASX listed price and to focus on the NAV, which reflects the true underlying value of the assets.

We quote a daily NAV figure that gives investors an understanding of the value of the portfolio of loans that are held within our funds. Each day the assessed market value of portfolio assets and impairment testing is reviewed by the Metrics Investment Committee and an independent expert. Any adjustments to carrying values are reflected in the daily NAV.

The valuation process is not just the opinion of Metrics, but it is independently overseen by The Trust Company (RE Services), the Responsible Entity. Importantly, an international accounting firm also undertakes an independent credit risk and market pricing assessment, and reports findings to the Responsible Entity. KPMG as the auditor of MXT, reviews valuations each half -year.

So, there is a high level of rigour around the testing, and risks associated with our loans and whether investors are exposed to any risk of loss.

The quoted NAV of MXT has never fallen below the IPO issue price, regardless of what was happening with the market price.

By focusing on the NAV and working to fully understand the asset class, investors will be able to take advantage of buying opportunities now and in the future and fully realise the benefits this unique asset class has to offer.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange