Five Common Myths about Private Debt

Common myths about private debt continue to cloud understanding of the sector to the potential detriment of investors.

These myths misinterpret key characteristics of the asset class to suggest it may be riskier than traditional assets such as equities and bonds, when it instead provides investors with an alternative that plays an important role in portfolios.

In reality, private debt has a strong track record of providing Australians with lower capital volatility and attractive risk-adjusted returns.

Below are five of the most common myths about private debt and the reasons why they should each be discounted.

Myth 1: A slowing economy increases the risk of loan defaults

Before drawing this conclusion, it is essential to consider the broader context. The historical net write-off of corporate loans by banks peaked at just 0.68 per cent in March 2010 in the aftermath of the Global Financial Crisis and were just 0.04 per cent in September 2024.(1)

Well-run private debt funds with skilled investment teams likely recorded similar results to banks. These lenders use a range of controls to protect investors and themselves from loss.

For example, quality lenders conduct rigorous scenario testing prior to finalising any loans to mitigate the risk of an economic slowing impacting their portfolios.

Private debt lenders are also entitled to confidential real-time information about a company’s activities to monitor the risks it faces in all market conditions.

This oversight of a company’s outlook means that a well-constructed private debt portfolio can deliver greater capital stability than shares or even the public bond market. The key to achieving this outcome is building a team with corporate restructuring or insolvency backgrounds – as well as experience in different economic conditions. With these skills, private debt managers can preserve investors’ capital across a full market cycle and deliver targeted returns.

Myth 2: A loan default is a credit loss to a lender

It is a fallacy that a loan default always results in a loss to a private debt manager and, by definition, its end investors.

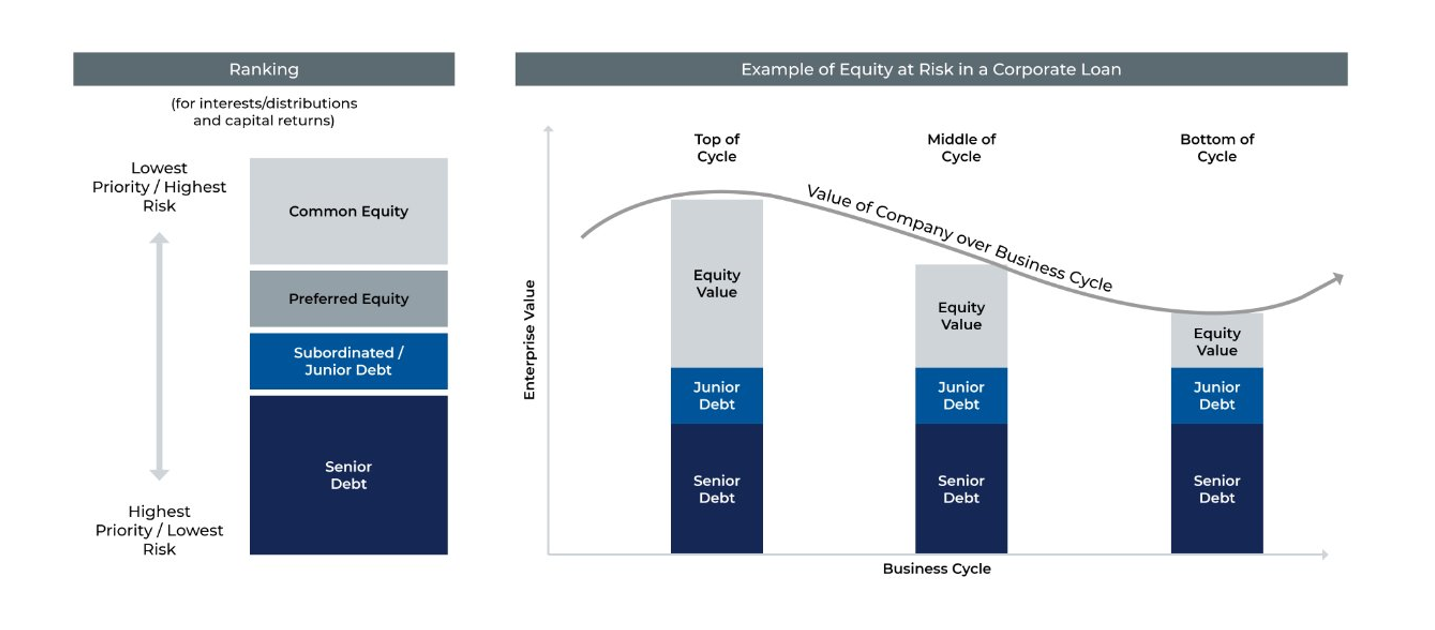

Lenders are protected by their seniority in the capital structure. Senior debt holders get their money back first, followed by subordinated (or junior debt) then preferred equity. Common equity holders – including ordinary shareholders – rank last in the queue.

Private debt investors, like bond holders, fall squarely into the creditor basket and are therefore in a better position than shareholders if a company’s financial position goes awry.

The covenants and controls imposed by a lender act as early warning signals of borrower distress. If there is a deterioration in credit or business conditions that might cause a decline in a borrower’s financial position, a lender can engage the company to work out the best approach going forward. The aim is to mitigate any risk of suffering financial loss.

Myth 3: All private debt managers are the same

This is as untrue for private debt as it is for any asset class. Private debt managers need to have sizable assets under management and the same level of credit skills as banks to achieve the optimal outcome for investors.

Scale provides a private debt manager with the necessary capital to directly originate loans and to diversify its lending across borrowers to mitigate risk. An extensive network of relationships with companies is necessary to secure the best lending opportunities and to offer funds catering to different investors.

Advanced credit skills allow a manager to choose the right borrowers and structure loans with the most appropriate covenants and controls. It’s equally critical to have the necessary skills to monitor borrowers over the life of a loan.

Metrics has been in operation for more than a decade and now has in excess of $30 billion in assets under management – and a strong track record of performance over that time.(2) It’s experienced team of more than 180 investment professionals has the capability to originate transactions directly with borrowers across the market – from corporate loans to project and infrastructure finance, commercial real estate borrowers and acquisition finance.

Myth 4: Commercial real estate debt puts capital at risk in a property downturn

Property owners are far more at risk of losing capital than a lender if the value of an asset falls.

Consider a property worth $100 million dollars with a loan to valuation ratio of 60% per cent. This means that the owners have borrowed $60 million against the property.

If the property falls in value by 40 per cent, to $60 million, the shareholders or owners would lose $40 million dollars on paper. But a lender wouldn’t necessarily lose a cent.

Owners’ equity in the property acts as a buffer on the small number of occasions that borrower’s default on their loan obligations.

Even if the lender takes control of the above asset, it’s still worth $60 million. This is equivalent to the size of the loan so there may no loss at all for the lender.

Before that happens, the lender has the right to compel the borrower to restore its position. For example, it can demand the borrower sell other assets or raise equity to pay down its debt.

Even repossession does not necessarily mean a lender becomes a forced seller – it can instead transfer the ownership of the property and pursue a sale at a later date to maximise profits.

Myth 5: Non-bank lenders are lenders of last resort

Competent private debt managers aim to lend to quality companies that can service and repay their debt.

This often means competing against the banks to attract borrowers or in some other instances, working alongside banks as part of lending syndicates which provide funding to companies.

Since most insolvencies in Australia occur in the small business sector, private debt managers with scale tend to focus on more established companies with annual revenue of $75 million to $750 million and/or so-called “large corporates” with yearly revenue exceeding $750 million.

The Global Financial Crisis prompted regulations which require banks to hold more capital, forcing them to reduce their lending activity.

This means companies can find it more difficult to access financing than previously, even though their fundamentals are sound. Raising public debt isn’t an option for many – as Australia lacks a deep liquid corporate bond market and most local companies are unrated by credit agencies.

Private debt fills this gap in the market by offering another means for those companies to obtain finance.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange