Finding defensive investment income without increasing risk

The RBA’s latest interest rate rise – which takes the cash rate to 2.35%, the highest level since 2014 – further highlights the challenges facing the property sector. The share prices of real estate investment trusts listed on the ASX are down more than 20% for the year so far. This has already affected the owners of these investment vehicles and the underlying buildings – but those on the other side of the transactions remain largely untouched so far.

For example, if a commercial property is worth $100 million and a financier has lent $60 million of that, the overall property value has to fall a long way before the lender starts wearing the loss. That’s what Metrics Credit Partners’ Andrew Lockhart means when he says that the first-order effects of declining property prices are felt primarily by equity investors.

Australia’s largest non-bank lender, Metrics Credit Partners manages a book of around $13 billion, of which $7 billion is to the commercial property sector. Lockhart, one of the firm’s four managing partners, describes Metrics core aim as providing an opportunity for investors to allocate capital defensively without sacrificing returns.

“For most investors, that’s quite challenging, with limited investment options across hybrids, traditional fixed income, or even cash,” Lockhart says.

“We believe we can provide greater levels of diversification, more stability and lower investor risk through private debt. That’s really what our funds are about.”

In fact, private debt funds such as those managed by Metrics can benefit in the current environment. As interest rates rise, the income levels for investors also increase due to the floating rate nature of the underlying loans. In the case of the Metrics Direct Income Fund and Metrics Master Income Trust, this income is diversified across a portfolio that spans around 280 underlying loans.

“On the income side, that comes from the fees we charge borrowers, alongside the interest margin we earn. The floating base rate (BBSY) also flows through as part of the total income we provide investors,” Lockhart says.

How Metrics is currently positioned

The vast bulk of Metrics portfolios is invested in senior secured loans, around 98%, with a portion of the ASX listed Metrics Income Opportunities Trust held in subordinated or mezzanine debt.

Most of the loans that Metrics writes are floating rate, which means the interest rate resets as the RBA’s official rate increases.

Most borrowers on Metrics books reset their base rate every 30 days, but they can also choose to reset this at 60 or 90-day intervals under the terms of their agreement.

“This is one of the benefits of investing in floating rate, short-dated exposures. As interest rates rise, the higher base rate immediately is charged to the borrower, delivering a higher total return for our investors,” Lockhart says.

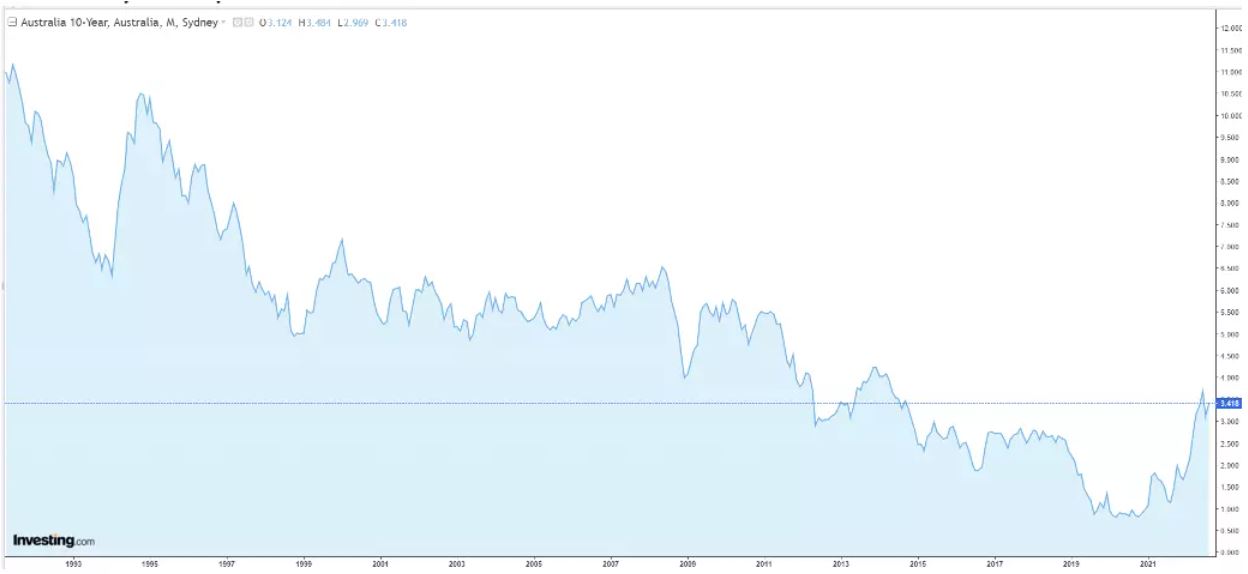

The spike in bond yields in 2022 so far ranks among the most aggressive on record

“As a business, we exist because most Australian companies are unrated and because Australia doesn’t have a deep, liquid corporate bond market. Companies rely heavily on mainstream banks for funding,” Lockhart says.

Referring to the above chart, one of the key implications of this prolonged period of high bond yields is the rising cost of funding for banks.

With cheap funding for banks no longer available, they’re tightening their liquidity while also widening their credit spreads.

“The challenge for banks is keeping a net interest margin between the cost of their own funding and the price at which they lend capital. That’s because they’re still required to generate an acceptable return for shareholders,” Lockhart says.

“The pendulum has very much swung back in favour of private lenders. Because we provide that stability of capital, where investors’ returns are based on floating rates, our investors are largely unaffected.”

Metrics also benefits from its shorter loan terms, which reduces investors’ credit risk by providing greater flexibility to reset the terms and pricing of loans regularly. It also provides greater liquidity across the portfolio and delivers another important source of investment income through the recycling of capital and collection of origination fees on new loans.

What’s top of mind for Metrics right now?

Effectively managing credit risk amidst the heightened volatility of financial markets, while also generating acceptable income, is Lockhart’s key focus currently.

“Our role as a lender is to look at each company individually, to determine what is driving cash flow, and how sustainable their businesses are,” he says.

Looking at agriculture or the mining sectors as examples, they’re also exposed to currency risk, commodity price risk, production risk and other things including the seasonality of weather conditions. These all create volatility in terms of the earnings companies can generate.

“As a lender, we’re looking for companies that are not exposed to significant external volatility. We find companies with strong, stable cash flows that have the capacity to service and repay their debt. That’s what we’re currently thinking about,” Lockhart says. “We structure the loan to not only accommodate rising costs and higher interest expenses but also build in additional buffers.”

What’s the biggest risk on your horizon?

“For us, because we’re so diversified, the risks will vary across individual companies, industries, and management teams. Our role is to identify those risks and determine how we can mitigate them when we lend to those companies,” he says.

“For example, people say they’re worried about what will happen if property prices fall 20% or 30%. Our job is to determine a company’s capacity to pay down their debt in such circumstances, or whether they’re just not financially strong enough.”

This is part of the reason why Lockhart and his team are so selective in their loan agreements, signing up only around 20% of the deals that cross their desk. That’s how they adapt during tougher market conditions such as we’re currently seeing. Regardless of the market conditions, companies will always require capital.

“Our role is to drill down to a very micro level, to identify the risks associated with each individual transaction and then seek ways to mitigate them. And that might also mean you just don’t lend to that particular company,” he says.

Looking for an alternative source of consistent income?

Metrics Credit Partners is a leading Australian non-bank corporate lender and alternative asset manager. Metrics seeks to provide regular and consistent income to investors through its portfolios of directly originated loans to Australian companies. Metrics team manage in excess of $13bn in funds from retail and institutional investors.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange