Do Listed Investment Companies (LICs) offer more opportunities than investors think?

In this article:

- Stamping fees have dominated much of the recent coverage surrounding listed investment companies (LICs), but it shouldn’t be the focus for fund managers in the industry

- In fact, there’s a battle within the current LIC space — and there are billions of dollars at play

- The winners benefit from greater liquidity, research and investor connections

- Meanwhile, the smaller players struggle to stay afloat, with many trading at significant discounts to their Net Tangible Assets (NTA)

- The current climate has lead industry leaders to ask what can be done to rescue the tarnished name of LICs

- However, in spite of present difficulties, it’s clear that opportunities are out there for those who weather the storm

Listed investment companies have dominated the business news cycle in the last few months. But maybe the pundits have it wrong.

The rhetoric around the use of stamping fees, which are paid to brokers and advisors who push LICs to mum and dad investors, has tarnished the name of listed funds.

However, in the current climate, it’s important to remember that LICs are viable and dynamic options for retail and self-managed super fund (SMSF) investors to diversify their portfolios and branch into sectors they would not otherwise have the expertise to invest in. In fact, sophisticated investors take the view that these assets are undervalued, sparking a trend of mergers and acquisitions in recent years that demonstrate the potential of smaller companies.

But right now, small and microcaps without independent research and access to retail investors are at the mercy of the big fish, failing to acquire the necessary liquidity to right the wide margins between their net tangible assets (NTA) and trading prices.

As the probing continues and discounts abound, smart investors will find opportunities within an industry under fire. But it’s up to fund managers to pull out all the stops and ensure their vehicles survive and thrive in a highly undervalued marketplace.

So, how can LIC managers pull this off? If we look at the major players, we see the answers in their profiles, extensive research and connections to retail investors. Telling their story and getting it out there could be the key to setting up an LIC for long term returns.

David and Goliath

When you look beyond the stamping fee debate, there are key winners and losers in the industry. LICs with a long history of performance, higher liquidity and sophisticated marketing continue to dominate. On the other hand, micro and small-caps with less liquidity are on the back foot when it comes to getting their message out to prospective shareholders.

If the smaller players are to rise, their fund managers need to find their niche, market to it effectively and create the crucial secondary market. This will help investors engage with company research and thereby boost liquidity, helping emerging funds stake their claim in the retail market.

Why is this relevant? Because, even among micro and small caps, there are billions at play. The LIC market has boomed in the last two decades, listing over 122 new companies since 2002. A combined market cap of over $55.4 billion has established listed funds as a lucrative investment opportunity.

And among a 114-strong industry, it becomes even more crucial that LIC managers find their niche within the LIC market and make it known.

The winning strategy

Those who are championing the LIC space benefit from a long-running reputation based heavily on performance.

A solid track record has proved especially beneficial to lead funds like Wilson Asset Management, which launched its first LIC in 1999. In 2018, the company sprang its sixth investment vehicle; WAM Global (ASX:WGB) onto the ASX.

Wilson’s fifth LIC was launched in June 2017. Since listing, WAM Microcap (ASX:WMI) has delivered a 21.9 per cent return on investments. WMI has also outperformed its S&P Small Ordinaries benchmark by 10.7 per cent.

Winners on the LIC market have demonstrated sensitivity to market conditions and their impact on shareholders. Over at Wilson, the powers that have made a name for themselves by agitating for change on a federal level. In 2018, fund manager, Geoff Wilson, helped kill Bill Shorten’s proposal to make franking credits nonrefundable by rallying 80,000 Wilson investors to campaign against the scheme.

Being intuitive to the economic climate can help emerging companies come out on top. Private credit investor Metrics Credit’s MCP Income Opportunities (ASX:MOT) trust was only founded in 2019, but managers have already made a big move by forgoing their annual performance fee following RBA rate cuts.

“As a result of these rate cuts, Metrics is entitled to a performance fee this year. We have therefore elected to waive this fee to ensure investors keep more of the trust’ outperformance in their back pocket,”

Metrics managing partner, Andrew Lockhart

Since listing, MOT has consistently traded at a premium to its NTA — currently, the trust boasts a 2.5 per cent premium in a $358 million market cap.

Meanwhile, MOT isn’t the only Metrics Credit listed trust to trade above its NTA. Its Master Income Trust (ASX:MXT) is currently trading at a two per cent premium in a market cap of $1.3 billion. And, both MOT and MXT have appeared in five independent research reports since listing.

The small-cap struggle

With less liquidity to play with, an emerging track record to uphold, and a limited number of professional investors in the industry, micro and small caps are suffering heavy discounts and are struggling to get off the ground beyond their IPOs.

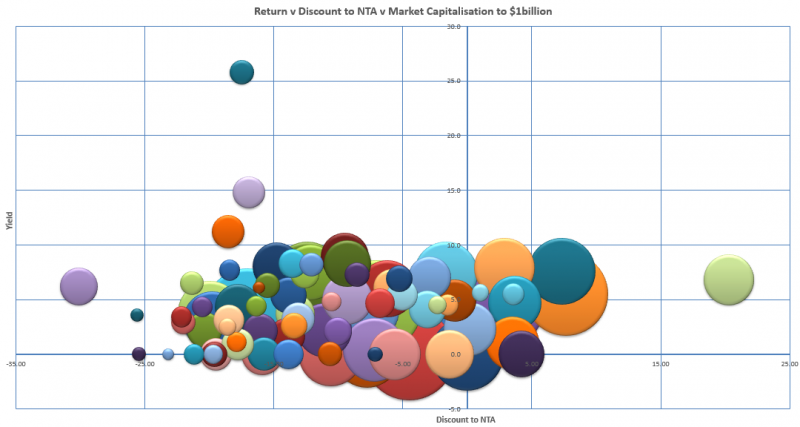

Analysis of Morningstar data has shown the vast majority of LICs with a market cap under $1 billion are trading at a significant discount to their net tangible assets (NTA). This is even more apparent in companies with a market cap under $200 million. Many discounted vehicles in this range are selling for anywhere between five and 25 per cent below their NTA value.

One such company is NAOS’ Small-Cap Opportunities (ASX:NSC). At the end of 2019, NSC was trading at an 11.18 per cent discount to its NTA in a $111.2 million market cap. However, the small-cap was able to deliver a gross yield of 9.9 per at the end of last year, making it one of the LICs with room to rebound.

NSC comes from a well established LIC player — NAOS has been around since 2013. The fund has built a platform around heavily vetting their investment portfolio, promising consistency in both its investment pool and fund managers. NAOS Chief Investment Office Sebastian Evans believes owning the story holds weight beyond a listed fund’s present performance.

“NAOS spends a lot of time and money on messaging and marketing, even though we’re not a profitable business … but I think you need to stick to your core philosophy, and we’ve been able to do that. And hopefully, it’ll bear fruit at some stage,” Sebastian said.

Those managing a micro or small-cap LIC in this environment shouldn’t despair. According to Wilson Asset Management Chairman, Geoff Wilson, a climate of low interest rates has created a greater demand for yield and an appetite for risk amongst shareholders. The factors that often make smaller LICs a gamble could be the key to attracting new investors.

What can be done?

In a booming industry, it becomes more important than ever that micro and small-cap LICs identify their story’s niche and own the space. Duxton Water (ASX:D20) has built a portfolio around investment in surface and groundwater assets. It’s a one-of-a-kind vehicle — the only LIC trading in the water entitlements space, giving its fund manager a unique selling proposition to bait investors.

In December, the company bought back over 1.5 million shares from its investors in a bid to increase the company’s liquidity and, in the long run, reduce the discount margin. While D20 is currently still discounted, there’s opportunity to move closer to the NTA in the future if the fund manager remains active in the space.

Through clever marketing to the right audience, an investment manager could drum up enough demand to rescue smaller caps, decrease the discount margins and give them the chance to perform over the long term.

But if managers are to convince professional investors to come to the party, investment consultant Dominic McCormick says they need to actively market beyond an LIC’s initial listing.

“The view that LIC and LITs are a near risk-free, business gravy train for fund managers is misguided. After 1-2 years of listing most managers and boards realise that to run a fund well they need to perform from an investment perspective, market the story well and manage capital efficiently.”

Dominick McCormick, The LIC/LIT “mis-selling crisis” is grossly exaggerated and the key issues widely misunderstood, December 2019.

Opportunities abound

Nowadays, while much of the rhetoric is focussed on a single aspect of the listed fund industry, managers have fresh opportunities to peddle LICs to a pensive market.

We can see that the small and microcap players are trading at somewhat of a disadvantage, with less experience, research and connections behind them. But by knowing their story and owning it within the LIC space, fund managers can begin to right the ship.

Having a long-term investment vision and harnessing each LIC’s unique selling proposition will be crucial for fund managers moving forward. Within the right niche, marketing to the right secondary market, there’s great opportunity to be had in a diverse and fruitful industry.

“Many of the LICs trading at discounts will cease to exist in coming years and others will see their fortunes reversed. For investors who love buying $1 for 80¢, the opportunities have only just begun.”

Geoff Wilson, Investment insight article, December 2019

The question remains; will this sentiment resonate with those who can make a difference, or merely fall on deaf ears?

themarketherald.com.au | February 05, 2020

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange