Innovative corporate loan fund reaches three-year milestone

Australia’s first ASX-listed corporate loan fund and the country’s largest credit LIT, the MCP Master Income Trust (ASX:MXT), recently celebrated a three-year track record of successful performance.

Launched in October 2017, MXT opened up a sector of the fixed income market that was previously only available to high net worth and institutional investors.

Commenting on the three-year milestone, Andrew Lockhart, Metrics Managing Partner said: “The Australian corporate loan market is an attractive alternative source of income from a capital stable asset class for investors and delivers an important source of non-bank debt finance to support the growth of Australian companies.

“We launched MXT to give investors a way to access this exciting opportunity set in a simple, listed format that provides liquidity not usually available in this asset class. MXT has delivered exactly what investors wanted in terms of capital stability and regular monthly income, even throughout last year when financial markets were at their most volatile thanks to the impact of the COVID-19 pandemic.”

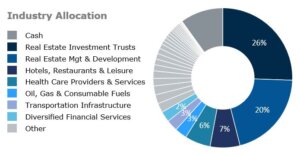

MXT invests in a diversified portfolio of more than 140 loans to Australian corporates, with the interest and fees paid by borrowers delivering monthly income for investors.

Delivering consistent above-target returns

Since inception (through to the period ending 31 January 2021), MXT has delivered a net return of 5.31%, a spread of 4.26% p.a. above the RBA cash rate, and well above its target of 3.25% over the RBA cash rate. MXT is positively rated by all the major ratings agencies, including a ‘Superior’ investment rating by Australia Rating Analytics (Australia Ratings) and a ‘Highly Recommended’ by Zenith Investment Partners.

The fund continued to deliver reliable monthly income throughout 2020 even as many equity investors experienced reduced income as companies cut their dividend payments to repair their balance sheets.

“This is a key benefit if you are an investor who relies on income to meet your day-to-day expenses,” Mr Lockhart said.

MXT has also been awarded Listed Fund of the Year by both Zenith and Lonsec, and Metrics was recently named Australia’s Best Alternative Investment Manager at the 2020 Australian Alternative Investment Managers Awards.

Fund performance to 31 January 2021

Metrics also offers a second listed ASX corporate loan fund, the MCP Income Opportunities Trust (MOT), launched in April 2019. Designed to provide investors with an alternative to direct investment in equities, MOT targets a higher cash yield of 7% p.a., paid monthly, with a total target return of 8-10%, net of fees and expenses. Since inception, MOT has also exceeded its minimum target return.

Metrics also offers a second listed ASX corporate loan fund, the MCP Income Opportunities Trust (MOT), launched in April 2019. Designed to provide investors with an alternative to direct investment in equities, MOT targets a higher cash yield of 7% p.a., paid monthly, with a total target return of 8-10%, net of fees and expenses. Since inception, MOT has also exceeded its minimum target return.

Capital stability in volatile times

Underscoring the capital preservation qualities of the funds, the value of the underlying assets has never fallen below the issue price. During 2020, the net asset value of MXT and MOT remained stable even as many financial securities, including equities and bonds, were heavily impacted by the economic fallout from the pandemic and many shareholders saw their holdings diluted as companies raised capital to repair balance sheets.

“That stability of capital in what was a volatile year for markets and the economy has demonstrated the strong risk management skillset within the Metrics team,” Mr Lockhart said.

“This careful management of risk has ensured that all of the loans within our portfolio have continued to perform, with no losses and no borrowers that are in arrears.”

The funds’ loan portfolios are well diversified by borrower, industry, and credit quality, and actively managed to deliver attractive returns while also preserving investor capital.

Mr Lockhart said a temporary dislocation between the net asset value and the traded unit price for the funds created a buying opportunity in early 2020.

Mr Lockhart said a temporary dislocation between the net asset value and the traded unit price for the funds created a buying opportunity in early 2020.

“Periods where markets become volatile and there is a dislocation between the net asset value and the traded price present an opportunity for investors to potentially buy units in the funds to take advantage of that dislocation. Investors who retained their holdings in the funds or bought units when the market dislocation occurred in early 2020 have done very well,” he said.

Metrics has a strict governance process in place to ensure the accuracy of the daily quoted net asset value of the funds, including independent oversight by responsible entity Perpetual and vigorous testing by auditor KPMG and a range of other independent due diligence, accounting and advisory firms.

“Investors should always have an eye to the quoted net asset value if they are going to make any decisions to transact in the traded unit,” Mr Lockhart said.

Economic recovery to create lending opportunities in 2021

The corporate loan market in Australia has traditionally been dominated by the major banks. However, an opportunity for non-bank lenders has opened up in recent years due to stricter regulation and capital adequacy requirements for banks. These requirements have increased the banks’ lending costs, which have been passed onto borrowers, making it viable for non-bank lenders to compete in the market.

Metrics expects demand for corporate loans to rise this year as Australia’s economy recovers from the pandemic related recession. “There will be increasing opportunities for us in the M&A, commercial real estate, and project and infrastructure space as government stimulus spurs activity and economic conditions improve,” Mr Lockhart said. “Our direct origination capability means we can move quickly to take advantage of opportunities as they arise.”

Other News

Graham McNamara to Retire as Managing Partner

Metrics Credit Partners (“Metrics”) today announced that Managing Partner Graham McNamara has advised the Board of his intention to retire,…

MCP Master Income Trust (ASX:MXT) successfully raises $315m in wholesale placement

Metrics Credit Partners is pleased to announce that Metrics Master Income Trust (ASX: MXT) will resume trading today following the…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange