Calm amid the turbulence: interest rates, volatility and private debt

The steepest rise in official interest rates since the 1990s is fuelling the hunt for investments that can preserve capital and provide regular income. After decades of low and falling interest rates, a sudden and sustained burst of inflation has forced the Reserve Bank of Australia to reverse course and begin raising the cash rate. Investors now fear the RBA’s actions could end Australia’s extraordinary run of economic growth, causing stress and volatility in financial markets. Private debt is an asset class that can offer both capital preservation and attractive risk-adjusted returns to investors.

Changes to the cash rate is the RBA’s main lever to keep inflation within the mandated 2-3% target band. It is also a key factor in the appeal of private debt for investors looking to protect their capital and generate regular income.

Official interest rates in Australia have been in long term decline since 1990 after peaking at 17.5%. They reached just 0.1% in November 2020 and stayed at the bottom until early this year as part of a years-long campaign by governments and central banks to stimulate economic growth in the wake of the 2008-9 global financial crisis (GFC). The low inflation that accompanied that sustained period of economic growth came to an end in 2022 as Government spending to counter the COVID-19 pandemic, related supply chain disruptions, and Russia’s invasion of Ukraine pushed prices for energy, housing, and consumer goods sharply higher. Central banks responded by rapidly raising interest rates. Since May, the RBA has increased the cash rate to 2.85% (in early November) and has noted further rises may be needed.

Private debt can benefit in the current environment because most underlying loans are short-dated and provided with floating interest rates – a fixed margin above the floating benchmark Bank Bill Swap Rate (BBSY). This means, as borrowers reset their rates, this should quickly translate into higher returns for the lender and as a result, income for investors.

Markets have responded to the uncertainty about how high rates may rise and fears of the impact of slower economic growth by selling off both bonds and equities.

The most recent slowdown was brief; in the middle of 2020, Australia’s economic growth fell for two consecutive quarters because of pandemic shutdowns. While this was quickly reversed by government stimulus, it sparked heavy losses in share prices and the delay, reduction, or cancellation of dividends to investors.

Prices for bonds have also moved sharply post the pandemic, raising questions over their traditional role balancing the risk of more volatile equities.

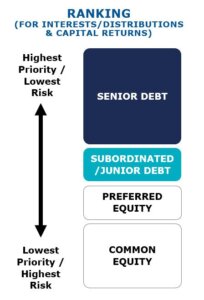

By contrast, the Australian corporate loan market was largely undisturbed by these events. This is not unexpected as corporate loans hold a senior position in the capital structure of a company and are protected by the equity, which bears the risk of first losses (Figure 1).

For example, if a property is bought for $100 million with a lender providing $65 million and the rest coming from equity, the value of the property would have to fall significantly before the debt, and particularly the senior debt, is impacted.

The majority of loans in the Australian private debt market are senior secured loans. This means the lender’s capital is protected by Australian laws that give them the ability to recover interest, principle, and fees from the assets of the borrower.

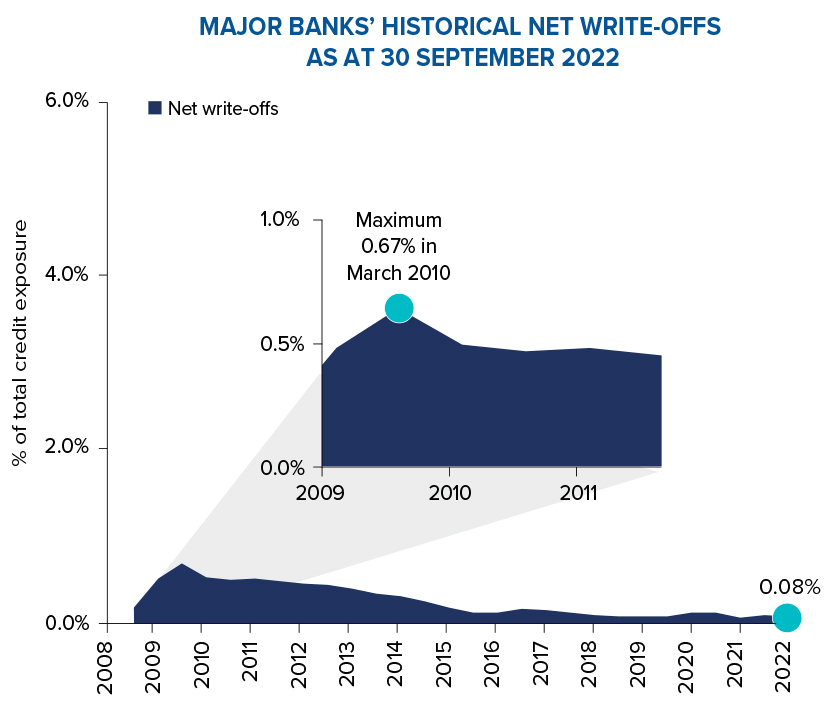

The strength of private debt’s position in the capital structure is highlighted by data on the banking system, which shows that credit losses in Australia’s corporate loan market have been low over a very long time. Losses were just 0.08% as a share of major banks credit exposures in Australia at the end of March 2022.

Since banks began providing data to the Australian Prudential Regulation Authority under the APS 330 standard in 2009, credit losses peaked at 0.68% in March 2010. This can be seen as the fallout from the global financial crisis (GFC), which included large corporate names such as BrisConnections, Allco and Babcock & Brown. By contrast, the peak to trough falls in equity markets during the GFC were around 50%.

Credit risk within private debt investing can be effectively managed, even during periods of heightened volatility, through a stringent due diligence and selection process, as well as ongoing monitoring of the borrowers. This is where a quality private lender will demonstrate its value to investors via the processes used to select borrowers, price credit, and manage individual loan and portfolio risk. The ability to control the terms and conditions and have access to detailed company information is a key distinguisher of private debt to corporate bonds or offshore tradeable debt, where the investor has no influence over the borrower.

It starts with the selection of borrowers and extensive due diligence to ensure they can generate the cashflow needed to pay the fees, interest, and principal on the loan. Lenders are looking for borrowers with a demonstrated track record in their business, and the ability to generate a strong cashflow, as that is what ultimately determines their ability to repay debt. Loans are structured to accommodate projections for rising costs and interest rates and include negotiated security and controls to protect the lender.

Lenders negotiate covenants and controls to ensure they have rights to monitor the loans over time and to set in place an early warning system for any changes in the business. With access to detailed information on the borrowers, lenders can quickly react to changes and, if required, limit the borrower’s other outgoings – such as dividends – to ensure the loan is repaid. Furthermore, almost all corporate loans in Australia are secured, which provides the lender with rights to enforce on its security and recover amounts owing ahead of other unsecured creditors in the event of a default.

At a portfolio level, risk management within private debt extends beyond the relationship with the individual borrower as exposures will be diversified across multiple borrowers, sectors, and industries. In private debt, investing size and scale is also important, as a larger lender has access to better-quality lending opportunities and can provide investors with exposure to a large number of high-quality borrowers within a portfolio.

Rising interest rates and volatile markets have created uncertainty for investors within financial markets, however some have been able to find consistent, strong income amidst the turbulence.

Private debt is an established asset class that has flourished in recent times, offering investors the benefits of:

- Attractive, reliable income – the majority of underlying loans in private debt funds are priced with floating interest rates. Thus, as interest rates rise, investors can expect increased returns protecting them against inflation.

- Reduced capital volatility – private debt exhibits a low correlation to public markets, meaning investors are shielded from much of the turbulence often seen in bonds and equities.

- Downside protection – the seniority and security of private loans provide protection, while tight covenants and controls ensure lenders can monitor and protect the value of their investments over time. These attributes, along with Australia’s stringent insolvency laws, have resulted in historically low credit loss rates.

Private debt is not an asset class that investors can easily access directly, therefore investors should look for a manager with the size, scale, and experience necessary to manage a diverse portfolio of corporate loans.

Other News

Metrics Income Opportunities Trust (ASX: MOT) | Investor Information

Metrics Income Opportunities Trust: income today with upside potential Metrics Credit Partners CEO and Managing Partner Andrew Lockhart recently spoke…

Metrics Master Income Trust (ASX: MXT) | Investor Information

Metrics Master Income Trust (ASX: MXT): disciplined income through diversified corporate lending Metrics Credit Partners CEO and Managing Partner Andrew…

INSIGHTS

MCP Income Opportunities Trust (MOT) lists on ASX

Sydney, 29 April 2019: The Trust Company (RE Services) Limited (ABN 45 003 278 831) (Responsible Entity) is the responsible…

MCP Master Income Trust wins Lonsec Listed Fund Award

The award came a year after MXT was listed on the Australian Securities Exchange