OVERVIEW

Unique access to a portfolio of private credit investments.

Metrics Income Opportunities Trust seeks to provide investors exposure to a portfolio of private credit investments. The Investment Objective of the Trust is to provide monthly cash income, preserve investor capital and manage investment risks, while seeking to provide potential for upside gains through investments in private credit and other assets such as Warrants, Options, Preference Shares and Equity.

View Target Market Determination

Attractive target monthly returns

The Trust targets a cash yield of 7% p.a. which is intended to be paid monthly with a total target return of 8% p.a. to 10% p.a., in each case net of fees and expenses*. *This is a target return and may not be achieved.

Distributions

It is intended that distributions will be paid monthly. The Responsible Entity has established a Distribution Reinvestment Plan (DRP) which will allow Unitholders to reinvest monthly income distributions.

**20 min delayed ASX traded price.

***Updated as at close of prior business day.

INCOME OPPORTUNITIES

Metrics is an Australian-based alternative asset management firm specialising in direct lending to Australian

companies and is an active participant in the Australian Private Credit market. We have significant experience

originating, structuring, negotiating, executing, distributing and managing portfolio risk associated with

investments in private credit. MOT seeks to offer investors:

- Monthly cash income with potential to participate in upside gains

- Access to the Private Credit market and asset class diversification

- Experienced, credible Investment Team with a proven track record in originating and managing Private Credit

investments - ASX market liquidity

Investment Strategy

The Trust will gain exposure to the following Wholesale Funds managed by Metrics:

- Metrics Credit Partners Secured Private Debt Fund;

- MCP Secured Private Debt Fund II;

- MCP Real Estate Debt Fund; and

- MCP Credit Trust.

By gaining exposure to these Wholesale Funds, The Trust may provide investors with exposure to the full spectrum of

Private Credit investments. The Trust will be mostly exposed to Loans, Notes and Bonds, however may also provide

investors with the potential for enhanced returns above those generated from the interest paid on Private Credit

through exposure to Equity-like investments such as Warrants, Options, Preference Shares or Common Equity as

considered appropriate by the Manager according to how it believes the Investment Objective can be best achieved.

EXTERNAL RESEARCH

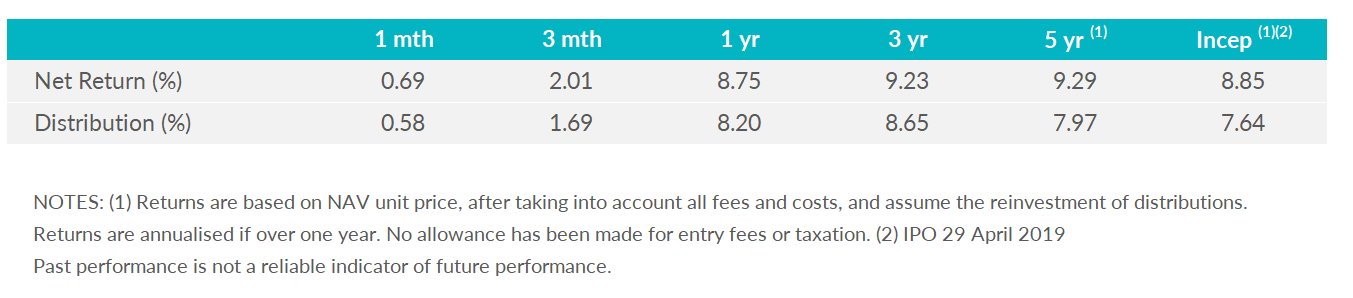

MONTHLY PERFORMANCE

Fund Performance as at 31 December, 2025

Investment Updates

The Metrics Income Opportunities Trust monthly report will be released around the 10th of each month.

The September 2025 Portfolio Report is now available.

The December 2025 Monthly Report is now available.

OVERVIEW

Unique access to a portfolio of private credit investments.

Metrics Income Opportunities Trust seeks to provide investors exposure to a portfolio of private credit investments. The Investment Objective of the Trust is to provide monthly cash income, preserve investor capital and manage investment risks, while seeking to provide potential for upside gains through investments in private credit and other assets such as Warrants, Options, Preference Shares and Equity.

View Target Market Determination

Attractive target monthly returns

The Trust targets a cash yield of 7% p.a. which is intended to be paid monthly with a total target return of 8% p.a. to 10% p.a., in each case net of fees and expenses*. *This is a target return and may not be achieved.

Distributions

It is intended that distributions will be paid monthly. The Responsible Entity has established a Distribution Reinvestment Plan (DRP) which will allow Unitholders to reinvest monthly income distributions.

INCOME OPPORTUNITIES

Metrics is an Australian-based alternative asset management firm specialising in direct lending to Australian companies and is an active participant in the Australian Private Credit market. We have significant experience originating, structuring, negotiating, executing, distributing and managing portfolio risk associated with investments in private credit. MOT seeks to offer investors:

- Monthly cash income with potential to participate in upside gains

- Access to the Private Credit market and asset class diversification

- Experienced, credible Investment Team with a proven track record in originating and managing Private Credit investments

- ASX market liquidity

Investment Strategy

The Trust will gain exposure to the following Wholesale Funds managed by Metrics:

- Metrics Credit Partners Secured Private Debt Fund;

- MCP Secured Private Debt Fund II;

- MCP Real Estate Debt Fund; and

- MCP Credit Trust.

By gaining exposure to these Wholesale Funds, The Trust may provide investors with exposure to the full spectrum of Private Credit investments. The Trust will be mostly exposed to Loans, Notes and Bonds, however may also provide investors with the potential for enhanced returns above those generated from the interest paid on Private Credit through exposure to Equity-like investments such as Warrants, Options, Preference Shares or Common Equity as considered appropriate by the Manager according to how it believes the Investment Objective can be best achieved.

EXTERNAL RESEARCH

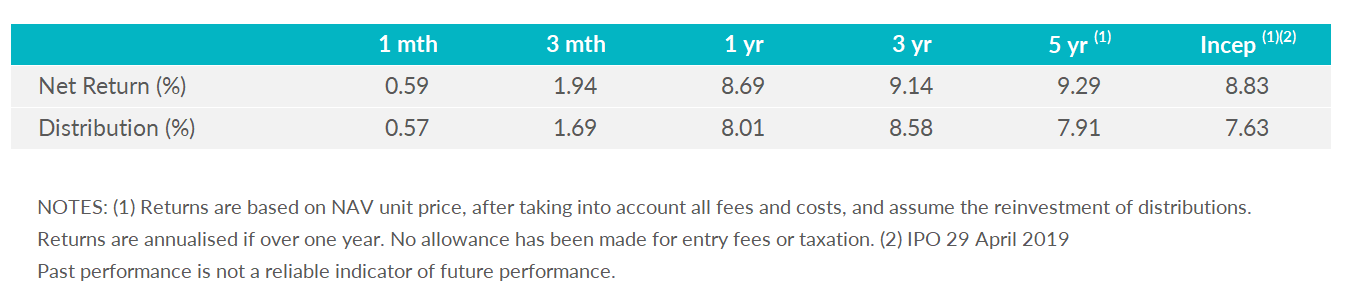

MONTHLY PERFORMANCE

Fund Performance as at 31 January 2026

Investment Updates

The Metrics Income Opportunities Trust monthly report will be released around the 10th of each month.

The December 2025 Portfolio Report is now available.

The January 2026 Monthly Report is now available.

MOT UNITHOLDER INFORMATION

Stay up to date with key ASX announcements including latest earnings, annual reports, important performance updates and other information.

Find out more about our latest news and information.

Metrics to cut performance fee to counter low rate environment

MCP Income Opportunities Trust (MOT) lists on ASX

Metrics raises $300 million for MCP Income Opportunities Trust IPO – proposed ASX ticker MOT

MOT Unitholder Information

Stay up to date with key ASX announcements including latest earnings, annual reports, important performance updates and other information.

Find out more about our latest news and information.

Metrics to cut performance fee to counter low rate environment

MCP Income Opportunities Trust (MOT) lists on ASX

Metrics raises $300 million for MCP Income Opportunities Trust IPO – proposed ASX ticker MOT

Disclaimer and disclosure

**20 min delayed ASX traded price.

***Updated as at close of prior business day.

All website content in respect of the Metrics Income Opportunities Trust ARSN 631 320 628 (the Trust) is issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235 150 (Perpetual) as responsible entity of the Trust. Metrics Credit Partners Pty Ltd ABN 27 150 646 996 AFSL 416 146 (Metrics) is the investment manager.

The information provided in this website is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Trust, you should consider the current Product Disclosure Statement (PDS) and Target Market Determination (TMD), and the Trust’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au, and assess whether the Trust is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser.

Neither Perpetual nor Metrics guarantees repayment of capital or any particular rate of return from the Trust. Neither Perpetual nor Metrics gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this website. All opinions and estimates included in this website constitute judgments of Metrics as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.

The Independent Investment Research rating requires to be read with the full research report that can be found on the investment manager’s website (or upon request) together with our full disclaimer that is found on the front cover of our research note. We require readers of our research note to obtain advice from their wealth manager before making any decisions with respect to the recommendation on this note. The note is not general advice, just financial information without having regard to the financial circumstances of the reader.

For all important information regarding BondAdviser Product Assessments please see the final page of the BondAdviser Fund Report or visit www.bondadviser.com.au.

Enquiries and Complaints

Perpetual’s complaints handling process has changed.

The Responsible Entity has established procedures for dealing with complaints. If an investor has a complaint, they can contact the Responsible Entity and/or the Manager during business hours, using contact details provided in the PDS. For more information on Perpetual’s complaints handling process, please click here.